- #QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION HOW TO#

- #QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION INSTALL#

- #QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION FULL#

- #QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION SOFTWARE#

#QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION HOW TO#

Also, the fact that you are willing to do some of the work personally or not. Not to mention that your budget matters a lot here. In short, relax and watch the work getting done for you! Which QuickBooks Payroll Option Fits Best for You?Ĭhoosing the best QuickBooks Desktop Payroll plan can be a bit intimidating. QuickBooks Desktop Assisted even takes care of the payroll set up for you.Īll you gotta do is take this plan, to ensure your employee’s hours getting entered into QuickBooks. As the name suggests, this plan generates your payroll for you and ingeniously files your payroll taxes.

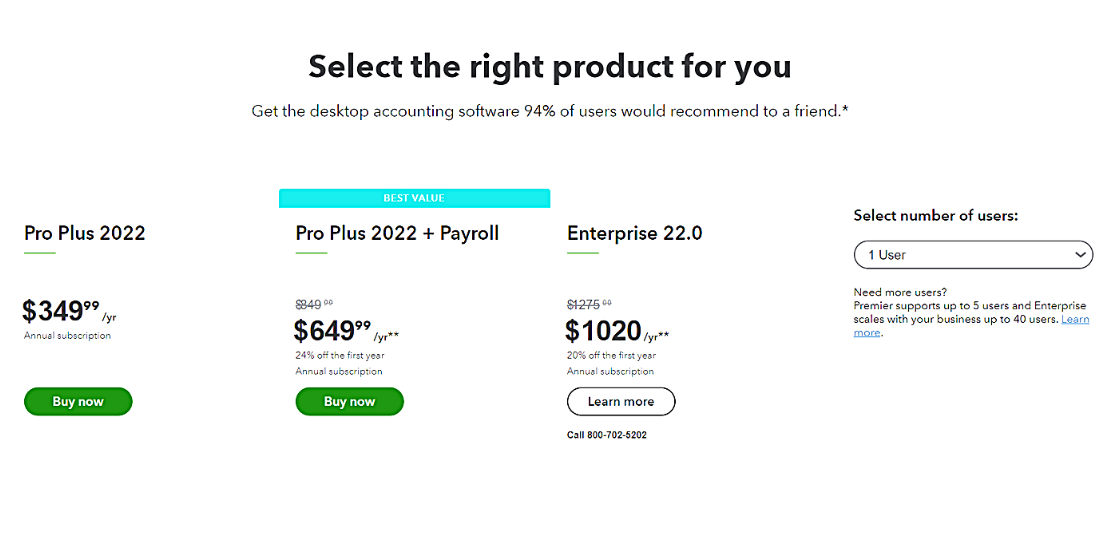

QuickBooks Assisted Payroll charges $109/month along with $2/month per employee (Intuit often offers a discount for Quickbooks payroll). Enhanced payroll allows you to process your payroll and file your taxes directly through QuickBooks. QuickBooks Enhanced Payroll costs $45/month +$2/month per employee (Intuit often offers a discount for QuickBooks payroll). This means that you will have to buy tax forms separately and file them on your own. However, like anything else in the world, Basic payroll also comes with a drawback- it does not include any of your payroll tax forms. However, it does help you in easily processing the payment for your employees by check or direct deposit.īasic payroll has the following features within itself. This one, like the name says, is the smallest plan of all. QuickBooks Basic Payroll costs $20.30/month + $2/month per employee (Intuit often offers a discount for QuickBooks payroll). Learning all about the three payroll plans.

#QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION INSTALL#

More importantly, QuickBooks hosting providers can install the solutions on Microsoft Azure VDI. Not to mention that the Gold or the Platinum versions of QuickBooks Enterprise already come with a payroll subscription.

Moreover, all the QuickBooks Desktop payroll options are companionable with QuickBooks Desktop Pro, QuickBooks Desktop Premier, and QuickBooks Desktop Enterprise. The options are different from each other in terms of features, automation, and price. It offers three payroll plans: Basic, Enhanced, Assisted. In case you are already looking into purchasing QuickBooks Payroll, then QuickBooks Desktop is here for the rescue.

#QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION SOFTWARE#

Thanks to accounting software programs like QuickBooks Services that are embedded with stupendous payroll features, thereby providing a plethora of resources that are rather handy in teaching you how payroll works and what your payroll obligations are. This also includes the systematic recording of all your employee’s tax information and staying ahead of all of the paydays. It’s such an apprehension to prepare a payroll, meanwhile also making sure your company is consistent with the payroll taxes.

#QUICKBOOKS PRO WITH PAYROLL WITH NO SUBSCRIPTION FULL#

After all, who doesn’t like to collect a paycheck deposit after a week full of hard work? However, it’s not that simple for the employer. The payroll process seems like a piece of cake when it’s you at the receiving end.

0 kommentar(er)

0 kommentar(er)